Pitch

We already have a carbon tax: existing gas and oil taxes. We give some political context for taking the first step on a carbon tax.

Description

Summary

Some political realities today: 1. Problems for Republicans talking about climate, 2. No tax-increase pledges, 3. A powerful fossil fuel lobby. There's no shortage of wonky policies, but hurdling these barriers may require demographic and cultural shifts over many, many years.

Despite the long game, we need to come up with a good hand of cards for two imminent events: the 2015 Paris talks, as China waffles on a carbon tax, and federal tax reform after the 2016 elections – the U.S.’s best opportunity to pass comprehensive carbon policy.

Other proposals on CoLab (and experts/economists far smarter than I am) have done analyses, measured impacts, simulated distribution scenarios, and spun variations on a revenue-neutral carbon tax and its place in the tax reform debate (e.g. lower the corporate tax rate in exchange). As underachievers, we take just one step – a carbon tax somewhere in the U.S. on something. The impacts may be negligible or hard to measure, but policy and political scalability matter more today than tonnage.

We describe two pillars for a carbon tax. The goals are to show China something in Paris and for a state to show something to the U.S. by 2016:

Take advantage of transportation finance reform and pipeline debates: even if Republicans warm to a carbon tax, it won’t be a priority. Two crises are priorities – 1) the bankruptcy of the Highway Trust Fund, and 2) decisions to expand pipeline infrastructure across the country. These two issues offer opportunities to raise an existing fossil fuel tax, if not an outright carbon tax.

Unify, reform and rebrand existing energy taxes: instead of a new system, let's unify various energy taxes at the state level into a single tax, whose goal is to shift the country away from fossil fuels. Moreover, at the state level, we argue for a short-term cut a unified energy tax in exchange for long-term price signal. At the federal level, we should rebrand the exotic, threatening "carbon tax" as a "fuel pollution tax."

Category of the action

Mitigation - Helping U.S. enact carbon price legislation

What actions do you propose?

Section 1: Use immediate needs in transportation finance reform and pipeline debates as opportunities to open an energy tax debate:

This section gives a primer on existing energy taxes. We aim to take advantage of existing taxes on fossil fuels for achieving the same purpose as a carbon tax without going through the difficult political exercise of passing something as alienating as a "carbon tax".

1.1 The Gas Tax and Transportation Finance Reform

Climate change is not a pressing enough political issue for a carbon tax to have legs at this point. But transportation finance reform allows for an opportunity to accomplishing the equivalent of a carbon tax.

Your Bridge is About to Collapse

State transportation budgets, of which most funding is derived from state gas taxes, are at a severe shortfall. In more than ten states, 20% of bridges have been deemed structurally deficient, resulting in incidents like the 2007 I35-W Bridge collapse in Minneapolis, which killed 13 people. In July of 2014, the Highway Trust Fund was going to be bankrupt by August.

Source: Financial Times.

Source: CBO.

Transportation budgets have been financed through “user fees”, in which those who use the roads pay for them. The user fee is implemented through the federal gas tax, which has been held constant at 18.4 cents per gallon since 1993, and state gas taxes, of which the average is 26 cents per gallon. The federal gas tax and most state gas taxes are not pegged to inflation and as a result, the real value of gas taxes has been decimated. On the horizon, increasingly efficient vehicles will further cut up transportation budgets.

The Gas Tax = An Existing $50 Carbon Tax

Transportation finance at the state level is an underappreciated medium for transmitting a carbon tax discussion into federal tax policy debates. A 44.4 cents / gallon tax and 8887 grams of CO2e per gallon of gas roughly equates to a $50 per metric ton “tax” on carbon that already exists. Raising the gas tax is equivalent to raising a carbon tax.

Moreover, state and federal transportation finance reform is already underway.

Prominent climate groups should take a larger part in the conversation around transportation finance reform, as the gas tax has more traction than a carbon tax (bipartisan support in fact).

Admittedly, gas tax would be hard to increase, but then a carbon tax, which would include a gas tax AND more, would be impossible. Regardless, we don't have to raise the gas tax. Keeping it at a constant rate but rebranding it as carbon tax can be a backup strategy (see Section 2).

1.2 Energy Taxes and Pipeline Infrastructure

While the previous section highlighted the consumer’s gas tax (downstream), this section looks at the system of oil and gas taxes as another opportunity to increase an existing "carbon tax" without calling it that.

Saudi Arabia of natural gas

By all accounts, the U.S. is undergoing an energy revolution, with natural gas fracking and EOR techniques greatly increasing the amount of gas and oil recoverable reserves. The U.S., as President Obama has said, is the “Saudi Arabia of natural gas.”

With bonanza profits for oil and gas companies, there is broad political consensus that states and feds should share in the rents through production and excise taxes. Conservatives are often leading the way. For example, Alaska’s Republican-controlled legislature and ex-Governor Sarah Palin raised the tax rate on oil from 22.5% to 25%, contributing a one-time “energy dividend” of $1,200 to all Alaskans. This sounds much like a carbon tax-and-dividend. Ohio’s Republican-controlled House passed a 2.5% severance tax on horizontal drilling (“frack”) gas.

Moreover, the growing libertarian/Tea Party/anti-Corporate strain of the Republican party could grow to accept an anti-Big Oil/Big Gas stance, which would make a tax even more viable. Kinder Morgan's tax antics certainly haven't endeared itself to unit-holders lately.

Raising the tax even more

Like the gas tax (and unlike a carbon tax), oil and natural gas taxes already exist, along with the political will to levy new taxes.

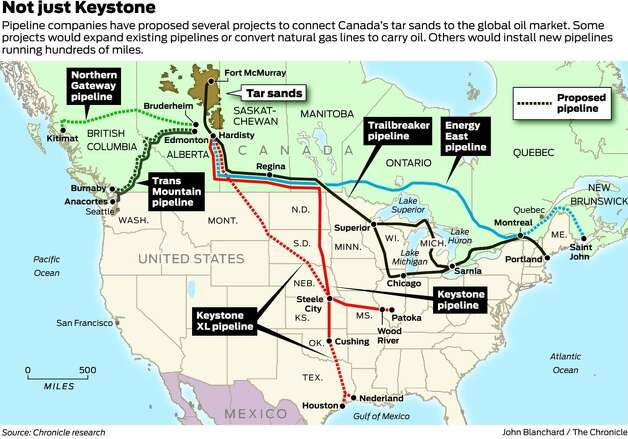

What would it take to raise upstream taxes? One of the biggest issues for oil and gas companies is pipeline constraints, leading to the need for Keystone XL for oil, or Kinder Morgan’s Tennessee Gas pipeline for natural gas. The West Texas Intermediate – Brent Crude gap has sat at nearly $20. Marcellus shale operators are racing for a pipeline to a sea so that NG exports may begin, which allows for much higher international prices.

Environmentalists have successfully made an issue out of these pipelines. One of the biggest grassroots environmental actions over the past two years has been the fight against tar sands and Keystone XL. Regardless of the fate of the Keystone pipeline, climate groups can use an energized base to pass meaningful policy – a stiff state tax that penalizes tar sands, frack gas, and heavy oil. A grand compromise could lead to the construction of some gas or oil pipelines in exchange for a much higher upstream tax on oil and gas that continues to be raised in the future. Work should be done to bring groups like 350.org, Greenpeace, Natural Resources Defense Council, Environmental Defense Fund, the Sierra Club and others on board.

Importantly, neither a higher gas tax and a oil/gas tax comes with the political baggage of a a "carbon tax".

Importantly, neither a higher gas tax and a oil/gas tax comes with the political baggage of a a "carbon tax".

What about the power sector?

When it comes to carbon, the power sector is much more regulated than gas and oil. Section 111d (the EPA’s sweeping new existing power plant rules), RGGI, WCI, and AB32 all have clear targets for the power sector. Adding a carbon tax on top of these thriving regional initiatives would add a confusing second layer. In contrast, oil and natural gas fuels, except as an input into power plants, are gaps in carbon regulation.

Moreover, it makes sense to keep power sector cap-and-trade initiatives going. Policy diversity is a good thing. In case cap-and-trade comes back into favor again, we will have the necessary knowledge to scale to a national and international level.

Section 2: Unify gasoline, oil, and fuel taxes by reforming and rebranding existing energy taxes

The previous section shows how we could achieve the equivalent of a carbon tax simply by raising existing fossil fuel taxes.

But if we are to achieve meaningful reductions and nationwide policy, we have to eventually acknowledge that taxes on natural gas, oil, gasoline, and even coal aren’t for the purpose of "sharing rents" or plugging transportation finance shortfalls. They are for transitioning the U.S. economy away from a fossil fuel-based economy.

Given an existing tax to start from in Section 1, this section addresses how fossil fuel taxes can be unified in one state for the purpose of GHG mitigation, in time for the 2016 tax reforms. Then, it addresses how federal rebranding of various energy taxes as a single “carbon tax” can be used as leverage in Paris.

2.1 State goal by 2016: get one state to pass a unified energy tax for the purpose of shifting away from fossil fuels

Currently, state and federal energy taxes are siloed. The gas tax, which is passed through to the consumer, is used to fund transportation systems, and exists on both the federal and state level. States with oil drilling and refineries have an oil production or excise tax that oil companies pay to go to general funds. On top of all of the taxes is a labyrinthine layer of subsidies for both fossil fuels as well as renewables.

Replace Gasoline Tax and Other Downstream Taxes with a Single "Fuel Pollution Tax" as Far Upstream as Possible

A single carbon tax as high upstream as possible (e.g. an oil production tax) would be efficient and politically feasible. Taking oil as an example, an oil tax could easily plug the transportation finance gap. The RAND Institute projects that a 17% tax on oil at $72 / bbl can generate $83 B / yr. – the annual funding need for highway and transit in 2011. A carbon clause could be added to an oil tax so that rates are higher for dirtier fuels – Canadian tar sands or Nigerian heavy oils, for example.

Current Brent prices are at $106, so the tax would generate an additional $40 B / y. beyond transportation funding needs. A tax on natural gas and coal would bring in even more revenue. If policymakers insist on “revenue neutrality”, extra revenue can be returned to people via a payroll tax deduction. It can also be used for alternative energy investments - we leave these decisions to better educated policymakers.

Oil Tax Pass-Through

The gas tax would be eliminated, which would be politically popular, as the gas tax is almost 100% passed through to consumers. By moving the point of taxation, oil companies, refineries, and pipeline operators could shoulder more of the cost of the tax (as much as 50% under certain conditions).

Upstream natural gas and coal taxes can also be added to the mix - we stick with oil as the prime example only for convenience.

To simplify even further, subsidies for both alternative energy and fossil fuels should be eliminated.

The key is a consistent framework that unifies all energy taxes within one state. Such a framework is one that could prove to be a model for the comprehensive tax reform discussions after 2016.

Getting the Escalator in a State

Even with a successful "unification” of existing oil, natural gas, and gasoline taxes, a carbon tax must rise faster than inflation in order to be effective. But it is extremely difficult to peg any kind of tax or subsidy to inflation, as evidenced in the gas tax discussion.

Much has been written about possible horsetrading for a carbon tax, which we won't repeat. As one more idea, we propose to take one step backward before taking two steps forward. The goal is “an accelerating escalator”, where effective taxes are first lowered for oil and gas producers in exchange for a ramp up in the escalator from 1% to 5% over the long term to make time for the right investments to be made. An example:

To throw out a more radical idea we have not yet seen, the government could institute price controls for oil, gas, and coal in which excess profits above a target price would be captured, and all shortfalls below a target price would be subsidized. The target price could then be lowered over time. If energy companies fear volatility, the government acts as a hedge in exchange for, once again, long-term clarity.

2.2 Federal goal by 2016: Have consensus around rebranding all existing federal energy taxes as "fuel pollution taxes", without raising any taxes and perhaps even lowering taxes

There's very little chance that the federal government would get as far as an escalator by 2016. But if there can be consensus around just the idea of a single system of energy taxation, it could be enough for a fruitful discussion in Paris.

In particular, the U.S. must be able to say, with credibility, to China and other non-Annex countries that it already has an "$x / mton" tax on coal, oil, and natural gas, respectively. This would be a strong bargaining chip for getting these countries to consider a similar price in on at least some fuels in their countries.

Again, in the U.S., it's true that such taxes probably already exist, but not under a single framework.

Rebrand as "Fuel Pollution Tax"

The key to success in Paris is a rebranding that is acceptable to both sides of the aisle. Carbon has become a toxic word - arguably even more toxic than "tax". Pollution, on the other hand, is unequivocally a bad thing, and campaigns to emphasize the health effects of power plant pollution over carbon have met with great success.

Existing fuel taxes can simply be rebranded, with the aid of environmental groups, climate-friendly businesses, and progressive conservatives. Without raising any tax technically, Norquististas could be satisfied. A rebranding could lead international progress towards thinking of energy taxes as "fuel pollution taxes and subsidies" as well. For Paris, transparency in international pricing may be a big win.

Who will take these actions?

The campaign for a unified carbon, oil, and gas taxation system begins with conversations and a working paper:

The core group:

- Conservative think tanks like the American Enterprise Institute, which has written on the carbon tax in the past.

- Climate groups like the Natural Resources Defense Council, and influential climate advocates.

- State stakeholders and legislators once the right state is chosen

The team behind this proposal has some networks among these groups and can begin to have conversations with high-level stakeholders, if given authority, access, and backing.

To be engaged:

- Transportation and oil stakeholders like Transportation for America and the American Petroleum Institute, for gauging their warmth to such an idea

Where will these actions be taken?

California may be prime candidate for a transportation fuel carbon tax. California contains many oil refineries and drilling for heavy oils (again, we use oil only as an example).

In fact, California Senate President Pro Tempore proposed a carbon tax on transportation fuels in early 2014 to help fund mass transit, transit-oriented developments, and road repair. It was scrapped since the environmental community and key lawmakers saw a tax as endangering the cap-and-trade market, according to some reports.

Importantly, the environmental community in California either stayed neutral or fought against a transportation fuel carbon tax. Environmental organizations could become convinced that a carbon tax has more traction on a national scale than cap-and-trade. Moreover, grassroots activists could make the connection that an oil-and-transportation-related carbon tax is an extension of the Keystone XL fight. A carbon tax in California could then have the support it needs.

California also has one of the highest fuel prices in the country. Gas and oil pipelines, like the Trans Mountain expansion, could bring relief to consumers. Alleviating supply constraints would lower gas prices in the short-term, in exchange for a quick rise in gas prices in the future. Any such policy would have to involve heavy public engagement on the future rise in gas prices - perhaps a second "cash-to-clunkers" for electric cars or 50 mpg and above cars.

Northeastern states may also be possibilities. Natural gas for heating, which is currently not directly regulated under any carbon scheme, could be the focus fuel to begin with in some of the New England states. A carbon tax in exchange for the Algonquin extension pipeline or the Kinder Morgan pipeline may be a working trade-off.

Alaska and Texas are conservative states that are undergoing demographic changes and booming oil industries. Hawaii has a $1.05 barrel tax, which could be a basis for more.

How much will emissions be reduced or sequestered vs. business as usual levels?

Returning to the beginning, as underachievers, we try to take only one step – a carbon tax somewhere in the U.S. on something. The impacts may be negligible or hard to measure, but policy and political scalability matter much more today than tonnage.

Scaling this to the federal level and influence international negotiations gets us closer to a comprehensive price on carbon. Such a policy is the holy grail of climate policy, eventually removing gigatons of CO2e.

Moreover, almost a quarter of the world's gas is sold at less than its market price because of market subsidies; in the 2008 energy price spike, for example, U.S. oil prices jumped by 33% whereas Chinese prices remained fixed, with oil refineries taking in the loss. We emphasize once again the importance of setting an example in the U.S. - a streamlined oil tax that also eliminates all subsidies could set an example for price transparency going into the 2015 Paris talks.

What are other key benefits?

See above. In summary:

- Plugging the transportation short-fall

- Lower gas prices in the short-term

- Continued encouragement of the economic development that oil and gas drilling may bring, as long as heavy R&D is committed to making the industry less carbon intensive (e.g. CO2 Enhanced Oil Recovery)

- Additional revenue to be returned to citizens

- Bargaining chip for international negotiations

- Short-term energy price relief combined with an accelerating escalators, giving energy companies and consumers a "head start"

Politically Possible

Earlier, we mentioned the political realities the country faces: 1. Electoral trouble for Republicans talking about climate, 2. No tax increase pledges, and 3. A powerful fossil fuel lobby. (1) is obviated by talking about oil and gas taxes instead of climate change; (2) is neutralized by lowering taxes in the short-run; (3) is addressed via giving oil and gas companies what they want. More analysis is needed, but these are kernels to start from.

What are the proposal’s costs?

In terms of gross revenue, the RAND institute estimates that a 17% tax on $73 / bbl of oil (note Brent oil prices as of July are at $106 / bbl) would generate $83 B / yr, the projected annual appropriation for federal ground-transit infrastructure in 2011. Note that this equates to a $12 tax / bbl, or $20 / mtCO2e.

At $100 / mtCO2e across the entire supply chain, revenues could be well over $200 B / yr, which could also finance state transportation needs and leave room for a common dividend and other needs that are currently being financed by state oil taxes.

In terms of net revenue, oddly enough, even a $100 / mtGHGe tax summed across the transportation fuel system could be revenue-neutral. Many of these taxes may already be in place. More research and analysis is needed.

The cost of the proposal, however, is less important than the political dynamics that enable a unified oil, gas, and carbon tax to be passed in the first place. We believe that pushing a carbon tax for the sake of climate change alone - creating a tax-and-dividend structure, for example, out of scratch, for the sake of climate change alone, without looking at political broader context - will be unpalatable.

Time line

· September, 2014: Pitch to the “core stakeholder” group in Washington, D.C., with the aid of the judging panel and the assorted networks of the authors

· January, 2015: Secure additional funding for a white paper, to be jointly authored by the core stakeholder group.

· February, 2015: Identify a state to focus on. Engage with state legislators and policy makers. Popularize a unified system of talking about our energy taxes as "fuel pollution taxes" on a federal basis

· June, 2015 to June, 2016: Public mobilization campaign. Get a unified energy tax system passed, with an escalator, in a state.

· 2015: Highlight and campaign for policy in various presidential and state election campaigns. Use the policy as a model in Paris talks.

Related proposals

The Little Engine That Could: Carbon Fee and Dividend: https://www.climatecolab.org/web/guest/plans/-/plans/contestId/1300404/planId/2802 This policy proposal is an efficient way of pricing carbon while returning money to people, and the concept is a rallying call for climate advocates. Our proposal takes a realistic look at how it might get done.

https://www.climatecolab.org/web/guest/plans/-/plans/contestId/1300404/planId/1307606: this is a summary of the Brookings Institution paper that details the trade-offs that could occur on a federal level

References

See in-line links.